CLEMSON, S.C. – Artificial Intelligence has shown measurable benefits to business, and a Clemson University researcher has found the real estate industry is one that would reap rewards by applying AI to determine a home’s true value.

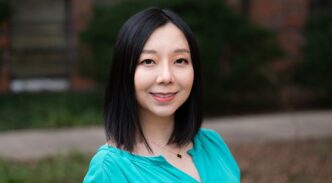

Lily Shen, assistant professor of finance in the College of Business, said AI, or Machine Learning, would benefit investors and homeowners alike by accounting for “soft information,” such as heated floors or custom closets, in property advertisements that existing real estate models do not capture.

“Companies and investors use hard data, such as square footage and the number of bedrooms and baths to determine a property’s value,” said Shen, who has done extensive research on Artificial Intelligence. “Unfortunately, the existing numerical models being used to determine a property’s value are not able to pick up unique qualities a home might have that may add significantly to its value.”

For instance, current models used to analyze a property’s worth will not measure the value of a gourmet kitchen remodel. These methods measure properties’ worth through numerical information only.

Shen said the researchers added a more sophisticated technology to existing databases. They trained their Machine Learning algorithm to understand the semantic meaning of real estate property advertisements in a way that hardens “soft” information, which allowed them to draw economic inferences about the impact of real estate uniqueness on sale prices.

The study, “Information Value of Property Description: A Machine Learning Approach,” was conducted by Shen and Stephen Ross of the University of Connecticut. Their research examined 40,000 homes in downtown Atlanta that sold from 2010 to 2017.

“We knew there was soft data in some of these homes but could not process it because current numerical models don’t address the unique qualities of a property,” she said. “Even adding a small amount of soft data to a property listing can lead to a 15 percent increase in property sales prices. In the Atlanta area, this could result in $5,000 to $6,000 difference in the value of a home.”

Beyond affecting the sale price for a seller, Shen said there are broader implications.

“If an investor, a mortgage bank, or the government, want to determine the increase in values of homes in any area, they can get a more accurate view by building the soft data into existing models. That way, investors, banks, and policymakers can have a better understanding of the market condition, or the investment value of the housing market,” she added.

And from a seller’s standpoint, during a boom market, people are willing to pay for remodels. A seller might be more apt to upgrade their home rather than sell “as is” if the value of that unique feature is going to be recognized.

“With Machine Learning, we can identify the unique characteristics of a home and better quantify its true value,” Shen said. “By employing Machine Learning to the existing process, we are adding a human-like touch to the model that better processes the information. It’s like sending an appraiser into a home, something investors and companies cannot do when analyzing many homes in a marketplace.”

# # #